Tummy tucks can and do vary from one insurance provider to another.

The answer to that question can be both yes and no, depending on the circumstances.

In most instances, tummy tucking is simply a cosmetic procedure, which means that most insurance policies will not cover it.

However, in certain cases, it becomes a necessary medical requirement to receive the procedure if you’re experiencing skin infections or rashes.

If you do choose to get it done, then your insurance might cover part of the bill.

However, if you’re suffering from skin infections or rashes, then it becomes an absolute medical necessity to have the procedure done.

Can A Tummy Tuck Be Covered By Insurance? Facts you must KNOW!

For issues like this, some of the costs might be covered by insurance.

Also, the other time or condition when a tummy tuck might be covered by insurance is if there is a large surplus of excess skin after the surgery, which can sometimes happen if the operation is done on the thighs, buttocks, upper arms, or abdomen.

In addition, in the case of a full tummy tuck, some insurance companies may even provide financing, which can help defray the expense of the procedure.

(Remember, however, that this isn’t usually a permanent solution. If you want to get covered by insurance, you’ll also need to think about other options.)

So can you get a tummy tuck to be covered by insurance?

Generally, yes – as long as you have all of your medical needs met.

In order to get financing, you may have to go through a plastic surgeon.

What happens at this point is that you would make payments to the surgeon, who in turn, would pay your medical bills.

Even so, tummy tucks are generally covered as an elective procedure.

That means that it’s a surgical procedure that has been done for purely cosmetic purposes.

However, what if your tummy surgery isn’t quite a sure bet?

For instance, what if you’ve already had two children and want a baby in the future?

Or what if you’ve lost the use of one of your major organs?

Or what if you’ve recently divorced and don’t know how you’ll pay for your surgery?

The answer may be that your tummy surgery can’t be covered by insurance, because it’s considered elective surgery.

As with many things, though, there are ways to get around this issue.

In the case of losing the use of a major organ, for example, some insurance companies will cover the cost of organ transplants.

However, they may only cover these transplants up to a certain amount.

You may also be able to get a percentage of your remaining breast tissue taken out in the procedure.

If you’re thinking about having a tummy tuck, you should talk to your doctor and see if there’s anything they can do for you to make the procedure cheaper.

Most doctors and plastic surgeons will agree that the less invasive and less traumatic the procedure is, the more money the patient will save in the long run.

For this reason, many plastic surgeons who perform tummy tucks are willing to help their patients in other ways, such as cutting out a portion of the patient’s belly button or doing a “hand exercise” that stretches the stomach muscle.

These types of activities can be done on a part-time or full-time basis and aren’t considered to be “performed cosmetic surgery.”

Does Insurance Cover Tummy Tuck For Back Pain?

If you are looking for back pain relief, then one of the options available to you is to have a tummy tuck.

This can be covered by your insurance.

So how does insurance cover tummy tuck for back pain? It depends on the policy.

When you have back pain, your insurer may want you to go to see a specialist before deciding that you need treatment.

If you have back problems in general, they will see you first.

Usually, this is for the purpose of diagnosing a more serious back condition or injury.

If your insurance company specializes in back conditions, then you should be able to find a specialist that specializes in what you need.

You can find out by calling your insurer.

If you do not know where to start, then you can get online and find companies that will let you compare their rates and features side-by-side.

So, for you to get an informed decision this will make it easier.

You can also find out from your doctor if your insurance policy covers tummy tucks.

Many policies do so find out which ones.

However, some policies do not.

This is something that you may want to check into as well.

Sometimes just finding out which ones will cover your procedure can help you decide.

If your doctor says it will be covered, then you can go ahead and book your procedure.

Of course, the actual cost of having the procedure can vary quite a bit depending on a number of factors.

This is why it is important to compare a number of different tummy tuck for back pain insurance quotes before making your final decision.

Take the time to look at several different policies online and see which ones have the best deals.

This can help you make a well-informed decision.

It can also help you to see what the procedure is going to cost overall.

Once you know this, then you can move on to finding out how much insurance will cost you in the long run.

Tummy tucks are a common procedure.

If you are looking to have this done, then you should be prepared to spend a little money on it.

Make sure you understand how much coverage you will need and what the price will be before you get the procedure.

When you need back pain insurance to cover your procedure, then you can rest easy knowing you will be covered.

This type of coverage can help you reduce your suffering while taking care of the problem.

Does Insurance Cover Abdominal Muscle Repair?

Does insurance cover abdominal muscle repair after an injury?

This is a question that many people who have recently experienced the pain of a herniated disc ask their doctors.

Fortunately, insurance does cover some types of surgery, and it may even cover some types of corrective exercise and physical therapy after an injury.

DR is a medical condition in which the abdominal muscles separate from the pubic bone and cause the abdomen to protrude.

Surgery is often an option but typically is not covered because it is seen as cosmetic; therefore, any exercise and physical therapy associated with the recovery process is not considered “cosmetic” and is not covered by insurance.

When it is paired with hernia repair (the term used to describe abdominoplasty), however, it becomes a little more clear.

If your insurance covers this operation, it can be very helpful if you need the surgery or if you need physical therapy (many insurance plans cover this when it is paired with hernia repair).

It is difficult to tell exactly which hernia repairs and exercises will be covered by your health plan.

Most plans use a standard formula for determining eligibility: the procedure must be minimally invasive, it must be elective (a procedure that enhances the patient’s health), it must not require a hospital stay, and it must involve minimal complications.

In addition, plans can vary by whether or not they will cover the costs of both surgical procedures and the time frame in which they are performed.

While you should always check with your health plan directly, there are a few things to keep in mind when you’re asking the question “Does insurance cover abdominal muscle repair?”

Many people are surprised to learn that hernia surgery is not covered in their healthcare plan.

This is because repairing a hernia involves the removal of muscle tissue, which is considered non-essential to the treatment of the patient.

Abdominal muscle repair is covered, however, when the repair is done during a “pregnancy” or while a woman is carrying a child.

The contract that you sign when you buy health insurance can have a significant impact on whether your coverage is adequate for repairing a hernia.

Even though it may be a surprise, breast surgery (also known as augmentation) is also not always covered on health insurance plans.

Health insurers view breast enlargement as elective or cosmetic, which means that they do not expect you to pay out-of-pocket for the procedure.

If you do decide to have the surgery, your insurance company will only pay for 50 percent of the cost of the surgery, with the remainder coming from your pocket.

However, there are exceptions to this rule.

If you are a mother who has certain medical conditions, such as diabetes, cancer, or HIV/AIDS, breast enhancement is often covered.

You’ll just have to pay a bit more than if you were just concerned with having a fuller, sexier torso.

What about hernia repair when it’s caused by lifting too heavy a weight?

If you happen to suffer an abdominal hernia as a result of working out hard in the gym, then chances are good that your health insurance will cover the cost of the repair.

Unfortunately, your local gym may not be able to help you out.

Not all gyms have well-stocked doctors’ stalls.

In addition, there are many gyms that do not participate in the health maintenance organizations (HMOs) that most people are signed up with.

These factors mean that it could take you quite some time before you’re able to get the operation paid for through your insurance.

What Weight Loss Surgery Is Covered By Insurance?

The answer varies from insurer to insurer, so it’s important to ask all the pertinent questions before making a decision regarding surgery.

Most health insurance policies will not cover bariatric surgery.

Bariatric surgery is a type of serious weight loss surgery used to treat severe obesity and other health problems resulting from being overweight.

Bariatric surgery is sometimes covered under special circumstances, such as when the patient has hernia complications and the procedure can be performed to correct the problem.

Sometimes the health fund will cover it if the patient undergoes extreme psychological stress after having bariatric surgery and it can be proven to be medically necessary.

If you’re unsure whether your surgery is covered by your health fund, check with your health insurer.

What weight-loss surgery is covered by insurance companies?

Generally, surgery is not covered by most health insurance plans, even though weight-loss surgery is very effective in treating most overweight patients.

Some insurance companies will cover bariatric surgery if it’s performed by qualified doctors and it’s performed for a life-threatening condition.

Ask your doctor or health fund provider whether your surgery is considered a life-threatening condition.

If your insurance company covers bariatric surgery, most health funds will not cover it, because it’s considered elective surgery.

Elective surgery is typically for cosmetic purposes, such as breast reduction, but it may also be performed to repair internal injuries.

Before you decide whether your health fund will cover your surgery, contact your health insurer to find out.

When an individual makes the decision to undergo bariatric surgery, they will have already done a lot of research.

Most people who undergo bariatric surgery will have considered what they want out of life and will have weighed the pros and cons of their specific surgery option.

For bariatric surgery to be covered by health funds, the patient and their doctor must discuss which surgeries are the best for them based on their overall physical and psychological needs.

Once this information has been gathered, the doctor will determine which surgeries will be covered by their health funds.

If you have done a lot of research and determined that bariatric surgery is the best option for your life and physical condition, then you may be able to find financing in your medical insurance plan to pay for the procedure.

For many individuals financing a gastric bypass or lap-band surgery can be affordable since most medical insurance companies do not cover elective procedures.

However, you should confirm with your medical insurance company to see what financing options are available to you before making any final decisions.

If your insurance company won’t pay for your weight-loss surgery, check with your health fund provider.

For patients who qualify for government aid programs, or if your health insurer doesn’t cover the cost of weight-loss surgery, there are financing options available.

Your health insurance provider or your financial advisor can help you find the right option for you.

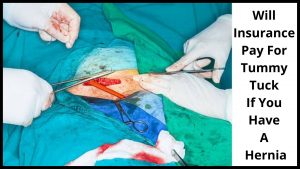

Will Insurance Pay For Tummy Tuck If You Have A Hernia?

Most insurance companies will only pay for the medical expenses of the tummy tucks if the procedure is deemed medically necessary and done by a board-certified plastic surgeon.

In many instances, insurance will cover only the hospital expenses after your plastic surgeon has fully analyzed you.

You will then be scheduled for surgery.

Insurance companies will then take care of the remainder.

However, it’s always a good idea to have an evaluation by your doctor before deciding if insurance will cover your procedure.

A hernia refers to the rupture or cutting of a sac that is located below the pubic bone.

This type of surgical procedure is performed primarily on individuals who have had accidents that caused their abdominal muscles to weaken and become imbalanced.

This results in bulging or protrusion below the abdominal wall.

A tummy tuck is a term used to specify a complete and comprehensive abdominoplasty.

A tummy tuck, or abdominoplasty, maybe the best option if you need major surgery to repair damage to your abdominal area.

Many who undergo this procedure are satisfied with the outcome.

Will insurance cover tummy tuck if you have a hernia?

This is a common concern among patients, especially if the procedure is considered medically necessary.

Although many insurance policies will cover surgeries like this, they will usually be very expensive.

One way to find out if your insurance will cover the cost of a tummy tuck is to ask a plastic surgeon if it is considered a medical necessity.

As with any surgery, there are several circumstances that may lead to a hernia repair being necessary.

For example, a hernia can occur after weight loss, obesity, pregnancy, and muscle weakness.

If you fall into one of these categories, then a tummy tuck may be the only option.

And If you have been recommended for abdominoplasty by your doctor, you will need to prove that you meet the pre-requisites set forth by your surgeon.

In order to do this, you must first go through a rigorous screening process that verifies whether your obesity, lifestyle, health conditions, and current medications are compatible with abdominoplasty.

The hernia procedure must be pre-planned in order to be covered by most insurance policies.

Most policies will require you to show that you have undergone several regular medical examinations to confirm that you are healthy enough to have the procedure.

It is a good idea to get a copy of your health history before beginning the search for a plastic surgeon.

You will want to make sure the procedure is covered by your current health insurance policy.

And you should also get pre-op and post-op medical care written confirmation from your doctor that you are healthy enough to have the operation.

If you fall into one of the above categories, then you should contact your insurance company and ask what types of tummy tuck procedures are available to you that will not break your budget.

Many policies will cover minor procedures such as liposuction.

These are often not covered if you have a hernia, but they are often much less invasive and bruising-producing.

For example, a Vaser tummy tuck is less invasive than a traditional tummy tuck and bruising producing.

Also, most plastic surgeons charge less for the more advanced procedures.

A mini-tummy tuck, for example, can cost in the neighborhood $2500 while a more advanced procedure might cost several thousand dollars.

The good news is that most insurance companies do not have any restrictions when it comes to cosmetic surgery.

If you have a pre-existing medical condition, however, there may be a limit on the type of procedure you can have or the coverage provided.

In addition, some insurance companies will require that you wait a certain amount of time before you can have the procedure.

In addition, because cosmetic procedures are elective, you may be denied coverage altogether.

If you have a high enough deductible, however, you may be able to get the procedure if you have a sufficient amount of insurance coverage.

In some cases, a tummy tuck is covered by health insurance.

Contacting one of your current health insurance companies to find out if they will cover the cost of a tummy tuck is an excellent first step.

If you do have health insurance, finding a surgeon with an excellent reputation is important.

You want to select a surgeon who will be able to perform a tummy tuck that will produce a symmetrical appearance so that you will not have any asymmetry afterward.

Does Insurance Cover Fat Transfer?

Liposuction and other liposuction procedures are typically covered if they are performed as a direct result of a medical problem.

For instance, if you have a medical condition that impairs your ability to tolerate caffeine, diet pills, or similar medications then you can use them to improve your general oral health.

Lipoproteins, fats, and other substances can be used to successfully perform fat transfers from one part of your body to another.

If it is performed to repair a physical defect then it might be covered.

For example, if you have a scar on your abdomen that causes you to be very overweight, then you can remove that scar and use the fat that comes off as gummy bear implants.

Insurance won’t cover the process, though if it is being done to enhance the aesthetics of your body.

Fat transfer and other types of cosmetic procedures can be a bit tricky.

If you’re looking into getting liposuction performed because of a physical problem then you need to make sure that you’re also doing everything you can to correct that problem.

And if you’re trying to get your butt implants removed because they don’t fit anymore then you need to consider getting breast reconstruction after the operation.

The insurance might cover the procedure if it is being performed for the medical benefit of the patient but will likely charge you an increased rate because of it.

Unfortunately, some insurance companies have begun to reject the idea that fat transfer is covered by their policies.

If you happen to go with one of these companies you may find that your insurance company doesn’t actually want you to have the procedure done.

Even in situations where there are pre-existing conditions the insurance companies may refuse to cover the surgery.

This means that you could be out of a few hundred dollars or even thousands of dollars if you have to pay out of pocket.

The best way to find out if your insurance company covers fat transfer procedures is to ask directly.

Most of the big insurers will be able to tell you specifically if the surgery is covered or at least has partial coverage.

The procedure typically covers liposuction, abdominoplasty, breast reconstruction, and tummy tucks.

Typically the insurance companies require that the patient is 18 years or older, be in good health and that the procedure be performed by a licensed, experienced plastic surgeon.

If you don’t meet these requirements, your procedure probably won’t be covered.

The other issue that many patients have regarding insurance companies that cover fat transfers is the expense involved.

Fat transfer can cost anywhere from two to six thousand dollars.

Not everyone can afford this amount of money upfront, which makes it difficult for many people to even get the surgery.

If you have the money to get it done then great, but if not you may end up spending a lot of money on liposuction and other invasive surgeries that will make you look better but won’t reduce the fat deposits that you have on your body.

Finding out if your insurance company will cover fat transfers is important, but you will still need to do your research to find out if you can afford the cost.

Will Medicaid Pay For A Tummy Tuck?

So will Medicaid pay for a tummy tuck?

Most likely yes, as long as you meet the above requirements.

In rare cases, if you have a particularly severe medical condition, your insurance provider may pay for some of the procedure, but not all of it.

In addition, it’s important to remember that in most cases, insurance companies only pay for it if they can prove that you are in a truly severe financial situation.

Therefore, before you make such a large decision, it is important to carefully consider your options.

What most people think about in this situation is that their state’s health insurance policy will not cover the procedure because it is considered a” Rare” Procedure.

There are several different terms that are used to refer to things that are considered to be rare.

For example, the term, ” Rare” means that it is an unusual case.

If you are in a rare condition then your insurance company should not cover you for it.

However, it is very unlikely that this will ever happen.

Insurance companies only pay for it in very extreme circumstances.

In most cases, they only will cover it when a person is severely obese, has multiple, risky medical conditions, has had their appendix removed, or has a malignant tumor.

The last thing that any doctor wants to do is surgically remove a healthy part of the body.

So what does Medicaid cover?

Medicaid covers the majority of procedures that are considered to be ” Rare”.

If your age is over 40, you are considered to be a rare case.

The exceptions to this are the surgical procedures that are considered to be very rare, like having a hysterectomy or getting a double chin removed.

What about surgery to remove cancerous cells?

Rarely will Medicaid pay for a procedure to remove cancerous cells?

If you are in a rare case, your insurance provider might cover the cost of a proctectomy or radiation therapy, but this is it.

And if your cancer has spread to other areas of your body, your medical insurance will not cover the cost of surgery at all.

Your only option then will be to undergo the procedure on your own.

Why Cosmetic Surgery Is Not Covered By Insurance?

Most patients are looking to have a better smile, and are looking for ways to achieve this without spending the thousands of dollars that most plastic surgeons charge for cosmetic surgery.

The reason that they are not covered by insurance is that it is considered elective cosmetic surgery.

As they are not considered medically necessary, insurance companies are not obligated to pay for them.

This is not the case when it comes to non-surgical treatments.

They are only covered if the procedure is necessary.

The only time that I can think of where cosmetic surgery would not be covered by insurance, is if the patient has a pre-existing condition that could be dangerous.

I will discuss what constitutes a pre-existing condition here.

First, let’s talk about cosmetic surgery.

If your reason for having cosmetic surgery is because you do not like the way that you look, then insurance will probably not cover it.

Most insurance companies require proof that the procedures are necessary.

Therefore, you would have to show them that you have had one or more surgeries that were elective in nature.

So, cosmetic surgery that is done to correct birth defects, such as micro-via, cleft lips, skin tag removal, etc, could be considered necessary, but it would still need to be approved by your insurance company before paying for it.

Now, let’s talk about non-surgical treatments.

Most of us get Botox, CEA (Chondroitin Sulfate), liposuction, and other similar procedures to help us with our appearance.

These procedures are not considered cosmetic surgery, because they do not change the way that we look.

So, if you have non-surgical treatments done to improve the way that you look, you will be able to get these treatments covered by your health insurance.

How about laser hair removal or skin grafts?

These are also considered non-surgical treatments, but they can be very costly.

So, if you have had these types of cosmetic surgeries, you may want to think again about getting them done.

Again, since they are not considered cosmetic surgeries, they cannot be covered by your insurance company.

It is best to check with your doctor to make sure that these procedures are allowed, because there may be occasions where your insurance will cover certain cosmetic procedures, but it will be at a very expensive price.

In many cases, it is more affordable to go and get these procedures done through a surgeon that specializes in cosmetic surgeries.

Why cosmetic surgery is not covered by insurance?

It is important to realize that when you consider the cost of having cosmetic surgery, it can often be more expensive than having a surgical procedure performed in the traditional way.

Not to mention, many insurance companies will not cover non-essential procedures.

When you consider the options and the price that you will have to pay, it is often much more affordable to just pay for it yourself.

After all, in most cases, you will not have an emergency situation that forces you to go and pay out of pocket for your cosmetic surgery.

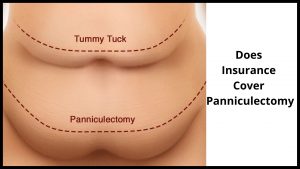

Does Insurance Cover Panniculectomy?

In most cases, insurance companies do cover at least part of this procedure, but there are some policies that cover only a portion of the procedure.

This is why it is important to read the fine print of any policy you sign.

It is also important to keep in mind that many insurance companies require written documentation for this particular procedure.

This procedure is done on those who have undergone surgery for some kind of health problem.

And this surgery also has the added benefit of improving the patient’s general well-being as it reduces the risks of developing other health problems in the future.

According to experts on health insurance, this particular procedure is not considered necessary due to the fact that there are many surgical procedures available today that can achieve the same results as the surgery which was earlier performed on the patient.

However, most insurance companies will pay for this procedure if they see that the patient needs it for his or her own good.

This is because it is proven that the excess skin or tissue causing health problems may be removed surgically.

In many cases, the excess skin or tissue may cause breathing problems, heart problems, and other similar diseases, and hence the insurance company may pay for this procedure.

Why is Panniculectomy covered by insurance?

This procedure is usually covered by health insurance companies when the doctor states that it will help improve the quality of life for the patient.

It is also covered when the doctor states that the removal of the excess skin or tissue will reduce the chances of developing skin cancer in the future.

This is mainly needed when the doctor performs the surgery on someone who has fair skin and dark hair.

A patient may have a good prognosis even without undergoing a skin graft.

However, some health conditions make it impossible to avoid skin cancer.

Even if the chances of developing skin cancer are low, when the skin cancer is located in an area that is easily visible such as the face, then this may cause embarrassment to the patient.

Also, the doctor may decide not to perform a panniculectomy if the patient is at a high risk of developing skin cancer.

Such patients include people with fair skin, light hair, open mouth, and large breasts.

It may also cover people who smoke or have a family history of skin cancer.

Why is Panniculectomy covered by insurance?

It is also covered if the operation is performed under general anesthesia.

The insurance company will pay for the cost of the procedure.

There are various reasons why panniculectomy is covered by insurance companies.

Another question often asked centers on the cost of the procedure.

Most insurance policies do cover at least some cosmetic procedures, but it is important to read each policy carefully.

For example, many policies will cover liposuction but may only cover breast reduction if it is medically necessary.

Some policies will cover abdominoplasty, but not a tummy tuck, and others will cover a variety of other cosmetic procedures, but not the tummy tucks.

It is important for patients to read the fine print before committing to this or any surgery in general.

If your insurance company does not cover Panniculectomy, you can find some companies that do.

In addition, several plastic surgeons offer this as a medical need-only procedure.

If you are seeking this kind of procedure as part of an extended medical regimen, it may be worthwhile to discuss it with your doctor, as it has its own set of pros and cons.

When you are looking to have this procedure done, it may be worth your while to ask your insurance company about Panniculectomy coverage.

In some cases, your insurance company may cover the costs of this treatment, or they may require you to get pre-certification.

And in all cases, though, you should get as much information as possible before signing anything.

If you decide it’s not something you want to try, at least you will be more informed about what you are actually paying for.

At the very least, you will know whether or not you are likely to be covered for it in the event of an emergency.

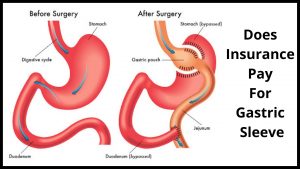

Does Insurance Pay For Gastric Sleeve?

The answer is yes.

In most cases, insurance companies are quite happy to provide the coverage necessary in order for an individual to be able to afford the surgery that is needed.

Your health insurance company may pay for part of the hospital expenses, but it isn’t likely they will cover everything.

Depending on your own healthcare insurance policy, your surgeon may be able to make recommendations about payment arrangements with your health insurance provider.

In addition, insurance companies do not cover any portion of the cost of gastric banding because it is considered a cosmetic procedure.

In some cases, the insurance companies will cover a portion of the hospital expenses only.

Unfortunately, this does not mean that individuals are not covered by insurance if they choose to have the surgery.

What it means is that the price will depend on a number of different factors.

One of these factors involves the age of the individual that is seeking to use gastric bypass surgery.

If you are a young person, you may be able to find a good price on your insurance policy when you seek to use gastric sleeve surgery.

What happens though if you happen to be an older person?

Does health insurance cover gastric bypass surgery?

The answer is a definite yes, but you may not be able to find a good price on your insurance.

One of the reasons why insurance may not be able to pay for gastric sleeve surgery comes from how the medical industry uses a standard.

When it comes to gastric bypass surgery, there are several different types that are used.

One of these types of gastric bypasses involves inserting a small pouch into your body in order to allow the food that you eat to bypass the stomach and go directly into your small intestine.

The problem with this type of gastric bypass surgery is that it can be very dangerous.

You may end up with a scar that is visible from across the top of your stomach, as well as an internal injury that can cause long-term scarring.

Another type of gastric bypass that may be covered by insurance involves a small pouch that is designed to help seal off your stomach.

This pouch is made in such a way that you will have to fill it several times a day with food until you are able to eat normally.

You may end up having to deal with several complications with this type of surgery, including the fact that you may end up feeling very uncomfortable because your body will be trying to digest too much at one time.

You may also end up with serious dumping syndrome that can end up costing you a lot of money.

One question you may have is “What if I am in perfect health and do not have any serious medical conditions or pre-existing conditions?”

You should not have to consider a gastric sleeve if your doctor has recommended it for you.

If you’ve been diagnosed with gastroenteritis, ulcerative colitis, Crohn’s disease, duodenal ulcers, or any of the gastrointestinal disorders that typically require surgery, then it is likely that gastric bypass surgery will be recommended to you.

As you consider gastric bypass surgery, if you are considering it as an option for your obesity problems, it’s important to talk to your primary care doctor about the procedure.

If your physician has recommended it for you, then he or she can explain all the facts about it and help you decide if you’d like to proceed.

And if you decide to get it done, then your surgeon will assign an experienced surgeon to your case.

He or she will probably use the services of a Gastric Bypass Specialists to assist in your surgery.

You should know, too, that gastric bypass insurance is not usually available from most insurance companies.

However, if your physician has explained to you that you meet certain requirements regarding your BMI, he or she may be able to recommend a company that offers this type of insurance.

Before contacting a gastric sleeve insurance company, you should also be sure to find out what the surgeon’s policy is regarding complications after the operation.

If you have certain pre-existing conditions, such as malabsorptive disorders, then you should also be aware of whether your physician feels that these conditions may qualify you for coverage.

And if you are interested in having gastric bypass surgery performed, you should talk to your doctor.

Find out exactly what your insurance will cover and whether or not you would be able to afford it.

Many insurance companies actually include coverage for surgical procedures like this.

However, you may need to shop around a bit before finding the right plan.

The more information you have, the better off you will be when it comes time to pay for your procedure.

Conclusion:

Before deciding whether or not you actually need to see a doctor and pay for the procedure, you should first determine the cost of having one.

It may seem like a lot of money, but remember that this is generally an invasive procedure and does involve any cutting or incisions.

You may, however, incur some costs related to post-op recovery, as well as stitches – these and some procedure costs may and sometimes be covered by insurance if medically warranted.

Ask your doctor about the cost and coverage of things like plastic surgery charges, anesthesia charges, and more.

Generally speaking, most insurance policies will cover some or all of these things.

If you’re currently uninsured or simply cannot afford the expense of getting a tummy tuck, there are other options available.

For instance, many hospitals now offer financing options for those who can’t afford the procedure.

While this generally isn’t offered on a “no claim” basis, many insurance companies provide payment plans that will help those who can’t afford the procedure make payments so they can get the procedure.

Of course, you should check with your own personal insurance provider to see what types of payment plans are available to you.

This may be an option if you’re trying to avoid making a larger medical payment in the event of something going wrong, such as the need for additional surgery, which oftentimes is a result of the excess skin and fat that’s removed during a tummy tuck.